Guest Post by Sarah Tedesco

Think of your nonprofit like a light bulb and money as the filament. You’ve got plenty of conducting wire to glow for a long time, but are you shining as bright as possible? Is your light reaching as far as it could or are you casting shadows upon donors just out of reach?

Think of your nonprofit like a light bulb and money as the filament. You’ve got plenty of conducting wire to glow for a long time, but are you shining as bright as possible? Is your light reaching as far as it could or are you casting shadows upon donors just out of reach?

Prospect research provides philanthropic and wealth data that helps you to spot the major gift prospects who will donate the additional funds that you need.

Below are five ways to convince the head honchos of your organization to make a strategic investment in prospect research.

Benefit #1 – Receive more information about existing major donors

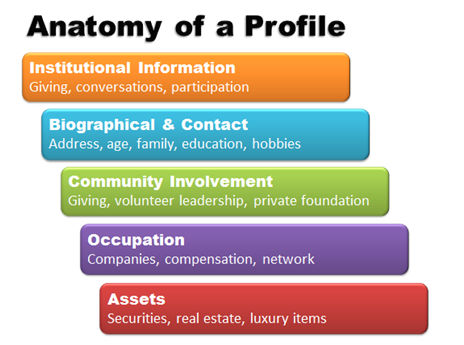

Does your prospect have a good poker face? Does he enjoy bubble baths with a glass of red wine? Is he an ancient Greek pottery aficionado? Prospect research won’t answer those questions, but it will deliver the sort of information that you need to improve your major gift fundraising.

Prospect research provides:

- Philanthropic histories – Know who your donors have given to and how much.

- Wealth markers – Discover what your donors invest in, such as stocks, real estate, etc.

- Group analysis of long donor lists – Receive comprehensive reports that summarize donor lists according to where they donate, how much, and more.

- Business relationships – Discover your donors’ employers to discover if they work for companies that offer matching gift programs.

- And more! – Different prospect research companies and consultants can deliver different types of information in different ways, so be sure to conduct research before you commit to a company or private researcher.

The fundraising experience becomes more personalized when you know more about donors. Your loyal donors are your most important donors, and remaining abreast of who they are and how to best continue to solicit donations ensures that your relationships will last.

Benefit #2 – Fundraise more efficiently!

While you’re busy hosting events, managing staff, and taking care of other tasks, your most valuable resource is always tick, tick, ticking away… Time.

With prospect research, you can pick out the highest quality major gift prospects on your list and dedicate your time, staff, and resources accordingly. Your fundraising efforts will be focused on the prospects who can deliver the biggest impacts for your organization.

Prospect research methods include:

- Screening companies – After compiling data from a plethora of databases, screening companies return comprehensive philanthropy and wealth data to help you identify your major gift prospects.

- Prospect research consultants – Consultants can provide you with a deeper level of research and fundraising insights on specific prospects. They can also help you streamline and coordinate all of your prospect research efforts. It’s important to know what you want from your consultant to achieve the best results.

- Do it yourself – There is an abundance of search tools out there, and you can teach yourself or get training for yourself or a staff member on how to conduct and manage prospect research.

Benefit #3 – Find and convert new major gift prospects

While modest donations help, major gifts deliver big, immediate impacts for your nonprofit, and finding more major gift donors is the fastest way to increase fundraising. However, when it comes to increasing your number of significant donors, new isn’t always better.

The top indicator of a major gift prospect is previous giving to your nonprofit, but that doesn’t mean that the previous giving is in the $5,000+ range of a major gift. Despite only giving modest amounts, your loyal donors are your most fertile source of new major gift prospects.

Annual donors, no matter how little they give, have a demonstrated, consistent affinity for your organization. Some of these donors can’t give more, but prospect research can reveal which ones can. However, if loyal donors have the capacities to give more, and care so much about your organization, then why don’t they give more?

The explanation may be as simple as that you’ve never asked these prospects to give more, so they’ve never thought to do so. There may be other reasons, and a thorough job of prospect research can help to solve the mystery, so you can turn these annual fund donors into major gift donors.

An old rule of prospect research is that 80% of funds are raised from 20% of the donations, although many organizations claim that it’s more like 90% of funds from 10% of donations, and others find that an even larger portion of their money comes from an even smaller contingency of major donors. You likely have several major donors, but the more the merrier, as these are the people who will provide most of your annual revenue.

Benefit #4 – Clean up your donor databases

Ring. Ring. Ri…

Prospect: Hello?

You: Hi! Is this Mr. Major Donor?

Prospect: I think you have a wrong number.

Fundraising doesn’t have to be like that phone call. You can call the right numbers more often than not, but only if you have up-to-date information.

Prospect research keeps crucial contact information up to date, such as:

- Phones numbers

- Email addresses

- Mailing addresses

- Spousal information

- Hobbies and preferred activities

- And more!

Don’t just take this new information and throw it into a cluttered closet. Embrace the opportunity to clean up your database, so that your donor records are easily searchable and accessible.

Benefit #5 – Identify planned or deferred giving prospects

You know that you can find new major gift prospects among your current donors, and that you shouldn’t overlook even low-level donors, but there’s also a specific type of major gift to be aware of.

Many donors save their biggest donations to be planned or deferred gifts, and, according to a planned giving expert, planned gifts typically come from regular, modest donors.

Prospect research provides the data that reveals potential planned giving donors.

Landing donations, and especially planned gifts, can be a long game, and donors have long-term value that might be patient to reveal itself. Prospect research helps you to find all of these people and delivers comprehensive information that allows you to make more individualized pitches that will better resonate with prospects and land more major gifts, even if they’re gifts that you have to wait a little longer to receive.

These tips should help you make the case at your organization for the importance of investing in prospect research! You’re a nonprofit with a bold heart and an important mission, so increase your fundraising with prospect research in order to focus on what you’re meant to do.

About Sarah Tedesco

Sarah Tedesco is Executive Vice President at DonorSearch, a prospect research and wealth screening company that focuses on proven philanthropy. Sarah is responsible for managing the production and customer support department concerning client contract fulfillment, increasing retention rate and customer satisfaction. She collaborates with other team members on a variety of issues including sales, marketing and product development ideas.

Sarah Tedesco is Executive Vice President at DonorSearch, a prospect research and wealth screening company that focuses on proven philanthropy. Sarah is responsible for managing the production and customer support department concerning client contract fulfillment, increasing retention rate and customer satisfaction. She collaborates with other team members on a variety of issues including sales, marketing and product development ideas.

Connect with Sarah:

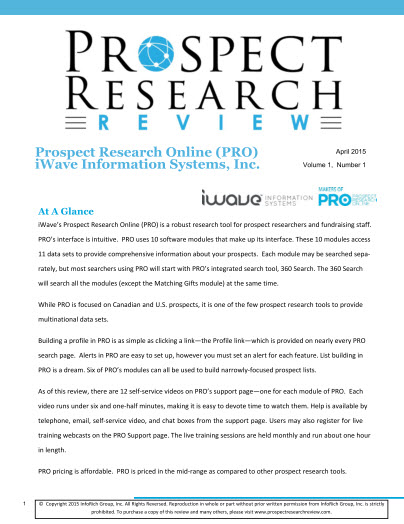

I don’t know if this has happened to you, but all too often I find an amazing product – a special soap or leak-proof mug – only to discover a few years later that the company is out of business and the amazing product is gone forever. Good products perform, but successful companies steward their customers.

I don’t know if this has happened to you, but all too often I find an amazing product – a special soap or leak-proof mug – only to discover a few years later that the company is out of business and the amazing product is gone forever. Good products perform, but successful companies steward their customers. Whether I’m teaching the

Whether I’m teaching the

Many of the important decisions about your life are made when you are not in the room.

Many of the important decisions about your life are made when you are not in the room.

I’ve selected three recent articles written by female fundraisers about wealthy women philanthropists. Enjoy!

I’ve selected three recent articles written by female fundraisers about wealthy women philanthropists. Enjoy! Think of your nonprofit like a light bulb and money as the filament. You’ve got plenty of conducting wire to glow for a long time, but are you shining as bright as possible? Is your light reaching as far as it could or are you casting shadows upon donors just out of reach?

Think of your nonprofit like a light bulb and money as the filament. You’ve got plenty of conducting wire to glow for a long time, but are you shining as bright as possible? Is your light reaching as far as it could or are you casting shadows upon donors just out of reach? Sarah Tedesco is Executive Vice President at DonorSearch, a prospect research and wealth screening company that focuses on proven philanthropy. Sarah is responsible for managing the production and customer support department concerning client contract fulfillment, increasing retention rate and customer satisfaction. She collaborates with other team members on a variety of issues including sales, marketing and product development ideas.

Sarah Tedesco is Executive Vice President at DonorSearch, a prospect research and wealth screening company that focuses on proven philanthropy. Sarah is responsible for managing the production and customer support department concerning client contract fulfillment, increasing retention rate and customer satisfaction. She collaborates with other team members on a variety of issues including sales, marketing and product development ideas. Can you imagine if that headline was about you? How would that impact your organization and your fundraising career? Would it be fatal or a blip in the radar?

Can you imagine if that headline was about you? How would that impact your organization and your fundraising career? Would it be fatal or a blip in the radar?