For the career prospect research professional, the ambiguity of wealth is a constant source of angst as we are called upon to offer our educated guess on an individual’s capacity to make a gift. In the U.S., we rely heavily on “visible assets” such as real estate and business ownership to provide concrete proof of wealth.

But when it comes to the very wealthy – and very philanthropic – we risk getting lost among the numbers, especially the zeroes!

Truth: The higher the net worth, the fewer the visible assets.

As I described in my previous blog post, Lose the Ownership; Keep the Wealth, in her book, Capital Without Borders, sociologist Brooke Harrington describes how the use of trusts to separate a wealth-creator from ownership of her wealth enables the wealth-creator to shield those assets from the vagaries of scrutiny, creditors, and taxes.

She shares how high net worth individuals (HNWIs) with as little as $1 million begin to shift priorities from growing their wealth to preserving it. Regulatory arbitrage is one of the preservation strategies used for this purpose.

Wealth Preservation and Regulatory Arbitrage

While titling assets under a trust is a broad and useful strategy, it also works and plays well with other strategies, such as regulatory arbitrage. Regulatory arbitrage is a simple wealth preservation concept with a cryptic name.

Have you ever witnessed (or experienced) a child who effectively manipulates his parents, playing one against the other? If Mom says “no,” he rephrases the request to Dad in a way he knows he’ll get a “yes.”

In this analogy, the child is the global elite and the parents are represented by different countries. Wealth managers are adept at negotiating the laws of each country to provide the best results for clients.

Regulatory arbitrage is choosing legal strategies or loopholes across countries that result in the highest amount of wealth preserved / lowest cost burden.

What Does This Mean for Philanthropy?

The use of regulatory arbitrage is perfectly legal, and it helps to explain why a search in the Offshore Leaks Database on the keyword “Foundation” yields so many results for foundations incorporated in Panama.

Unlike a trust, a Private Interest Foundation in Panama is based in Civil Law, which makes it much less likely to change. The foundation is not intended to manage active company business, but holds assets for the benefit of beneficiaries.

The Private Interest Foundation has many perks, including the following:

- The owners can be anonymous and the foundation’s charter does not have to specify who does what or when; this can be handled in private agreements.

- Owners can remain completely anonymous.

- There are no taxes.

- Creditors cannot pursue claims on it and liens cannot be levied against the foundation.

And while we often think of offshore accounts and exotic wealth preservation strategies such as regulatory arbitrage being used by only the ultra-wealthy, these tactics are available much lower down the wealth scale.

As an example, I clicked through the list of foundations in the Offshore Leaks Database until I found one linked to a name I could search on. The Valorie Foundation was connected to Dr. Juan A. Chiossone Kerdel.

A quick search on name-only suggests that it might be the same person as Juan Armando Ant Chiossone Kerdel, MD, MA, FRCS who is a practicing doctor at the University of Miami Health.

Billions of Shades of Green

In 2014, Bloomberg Businessweek published an article (and a fabulous visual chart) revealing how a trio of hedge fund magnates had used offshore entities to make charitable contributions of more than $10B. By way of comparison, The Robert Wood Johnson Foundation has assets of $11B, Fidelity Charitable has $21B, and Bill and Melinda Gates Foundation has $52B.

In 2017, David Callahan wrote an article about the same hedge fund philanthropists noting:

“But it was stunning to learn that one of the largest philanthropic enterprises in American history—with assets several times larger than a well-known legacy funder like the Carnegie Corporation—had been operating in total secrecy.”

So, while fundraising research will necessarily continue to pursue the gift capacity rating game, I leave you with two parting thoughts to keep in mind as you and your organization seek to build relationships with HNWIs:

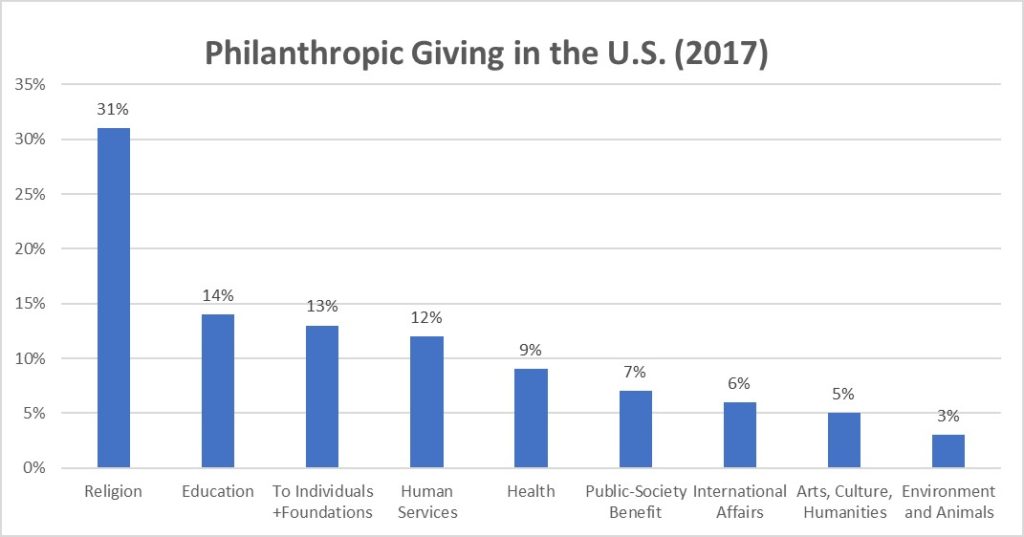

- People give for their own reasons – understanding motivations for giving is far more important than finding an “accurate” gift capacity amount.

- HNWIs may have less, but often much more wealth available for philanthropy than you can imagine.

Additional Resources

- Offshore Leaks Database | The International Consortium of Investigative Journalists

- Uses of Panama Foundations | POLS Attorneys | undated

- Vast Wealth, Hidden Foundations: How Much Do We Really Know About Billionaire Donors? | David Callahan | 2017

- The $13 Billion Mystery Angels | Bloomberg | 2014

- Capital Without Borders | Brooke Harrington | 2016

- What is Wealth Management? | Forbes | 2014 | Nice article describing how wealth managers are different from financial advisors

Ratings… indicators… categories – whatever the name, we use them to help us make sense of too much data. We use them to solve the problem presented in the question: Where or with whom do I get started? They help us navigate the world. But they can also limit our world – and our ability to feed the prospect pipelines of the future.

Ratings… indicators… categories – whatever the name, we use them to help us make sense of too much data. We use them to solve the problem presented in the question: Where or with whom do I get started? They help us navigate the world. But they can also limit our world – and our ability to feed the prospect pipelines of the future.