I will admit to being fascinated by, if not obsessed with, the path that leads to a major gift program for smaller nonprofits. What I hear and read about the most are large nonprofits, most of which are in higher education.

I will admit to being fascinated by, if not obsessed with, the path that leads to a major gift program for smaller nonprofits. What I hear and read about the most are large nonprofits, most of which are in higher education.

This frustrates me. It’s akin to walking into retail stores only to find nearly everything is focused on the top 1% ultra-high-net-worth individual. What about the rest of us 99%?

With the cost of research tools going down and their quality and usefulness going up, the world of major gifts is beginning to tempt the masses of nonprofits serving our communities. Whether it’s a wealth screening, look-up tool, or a database with CRM capabilities and built-in ratings, the small nonprofit can see those major gifts on the horizon.

But what is the path between starting and arriving in a major gift program?

Assuredly there is no single path to a major gift program, but research can provide illumination along the way. Over the past couple of years my consulting practice has become more focused on helping the smaller nonprofit – inside AND outside of a campaign.

The first step to major gifts is having a development officer who embodies relationship fundraising and has experience asking and receiving large gifts. Previous experience where there was access to and good use of research means things will move along much faster.

Start with the Data

The foundation of a sustainable major gift effort, whether that is larger annual solicitations or multi-year leadership gift opportunities, is good data practices. It really doesn’t matter how big or how small the development shop, without good data practices there is no sustainable progress.

Sometimes organizations are ambitious and reach out to hire a prospect research professional hoping that by using research early they will get a head start. But once hired they discover that the researcher must spend the first year or so doing nothing but getting the data practices in order. This can be very frustrating for both parties!

A well-run development office demands good data. Gifts are properly recorded, acknowledged, and thanked. Direct appeals are regularly mailed and emailed. Sponsors and guests are invited to a signature event. Grants are tracked and program results reported. Volunteers are tracked and supported.

Leverage the Data

Once you have good data practices, you can avail yourself of affordable research technologies such as wealth screenings. For quite a while now I’ve been helping nonprofits with wealth screenings in two primary ways:

- Screening the active donor base to assess fundraising potential for goal-setting and to prioritize the best prospects.

Many times I get called on by a fundraiser who has taken on a new development officer position. She wants to really organize and grow the nonprofit’s fundraising and puts a high priority on relationship-building with the best donors and prospects.

But working through the screening process is a big distraction. I help her get the screening results and understand the picture painted by those results. We walk through what kind of fundraising potential is there and how she can most effectively apply the results to her existing fundraising program.

- Screening all or a portion of the database and verifying the top-rated to identify major gift prospects.

Outside of a campaign, most often I do screenings and verification for newly hired fundraisers who are dedicated full or part-time to raising major gifts. The record count is manageable and I deliver new names monthly while reviewing past outreach.

With a skilled relationship-based fundraiser, this kind of project yields exciting results! Donor connections are made on many levels with leadership, board members, and staff. It’s an intense period of time, but once the list has been worked through I’m usually finished. Strong fundraising results mean staff is often added to assume some research duties.

Create New Procedures

With good data underpinning fundraising efforts, most organizations benefit next from slightly more formalized procedures. For most of the nonprofits I work with, even with some impressive total fundraised dollars each year, they are operating with skeleton staffing and very limited external resources.

Working with nonprofits to develop new procedures is one of my favorite activities. It’s a messy business as they try to figure out how to make things work best inside their organization and also with their constituents. I like to stick with them as they begin really calling on and building relationships with donors and prospects.

We work out what a good prospect looks like, talks like, is motivated by, and where a good prospect engages with the organization. Then I get to translate that into replicable procedures. I outline the way we used multiple data points to segment donors. I document how decisions were made about prospect assignments. And I offer advice and resources whenever appropriate.

Slowly a major gift program takes shape and begins performing.

Inform Cultivation and Solicitation Strategies

By far my favorite activity is researching prospects and having strategy conversations with the development officer. The bigger the gift opportunity and the deeper the research the more fun it is.

Doing this kind of work is like taking a tangled mess of jewelry and carefully and methodically unraveling it and polishing it until a glinting, sparkling necklace is revealed in all its glory!

This is the work and these are the conversations that can’t be completed by algorithm or otherwise mass produced. It’s wonderfully and deeply personal for the development officer, the organization, and most of all, for the donor prospect.

Sometimes the development officer might be intimidated by the prospect, and I can offer validation, encouragement, and confidence. Sometimes the development officer is optimistic and ambitious, and I can offer grounding and multiple scenarios – just in case the biggest number isn’t possible.

It All Starts with a Relationship

Prospect research has been a good career fit for me. There is a wide variety of tasks to perform and being methodical and analytical just makes me happy. But understanding the importance and practice of relationship-building has come more slowly to me.

After being a research consultant for over a decade, I incorporate the tenets of relationship-building into my research approach to the best of my abilities. I have also learned to recognize development professionals and organizations that value relationship-building and those that don’t. These days, I only work with the former.

There are many paths to a sustainable major gift program, but every one of them requires a skilled relationship-builder.

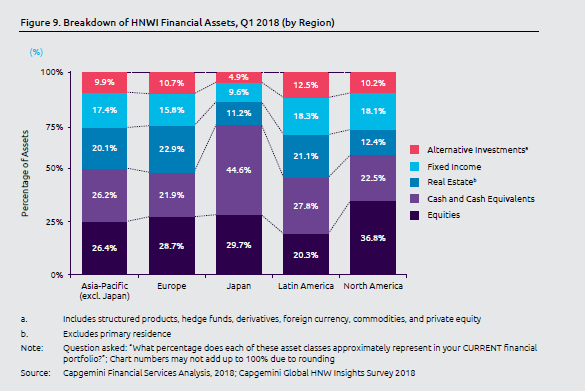

I get it. Your organization is not going to ask for millions even if the prospect could give millions, so why should you spend your limited emotional energy trying to understand HNWIs (high net worth individuals) and global wealth trends? The clear majority of nonprofit organizations in the U.S., around 80%, have operating budgets of $1 million or less.

I get it. Your organization is not going to ask for millions even if the prospect could give millions, so why should you spend your limited emotional energy trying to understand HNWIs (high net worth individuals) and global wealth trends? The clear majority of nonprofit organizations in the U.S., around 80%, have operating budgets of $1 million or less.

Higher education and healthcare dominate the field of prospect research – and for good reason. They have income well above the funds they raise and these big budgets attract correspondingly big gifts. But those industries no longer dominate wealth/prospect screenings. Or at least, they don’t have to.

Higher education and healthcare dominate the field of prospect research – and for good reason. They have income well above the funds they raise and these big budgets attract correspondingly big gifts. But those industries no longer dominate wealth/prospect screenings. Or at least, they don’t have to. Do you dream of creating the perfect prospecting system? A system so flawless that the ratio of prospects to donors drops to 2:1 or even (gasp) 1:1? I do! And yet, barring advances in ESP, a 1:1 ratio feels quite out of reach. We simply don’t have access to people’s complex, internal motivations for giving until they get visited and share. Even so, we still have plenty of room to achieve better prospect-to-donor ratios.

Do you dream of creating the perfect prospecting system? A system so flawless that the ratio of prospects to donors drops to 2:1 or even (gasp) 1:1? I do! And yet, barring advances in ESP, a 1:1 ratio feels quite out of reach. We simply don’t have access to people’s complex, internal motivations for giving until they get visited and share. Even so, we still have plenty of room to achieve better prospect-to-donor ratios. Gift capacity ratings were a marketing moment for wealth screening companies. Suddenly thousands of records could be matched individually to wealth records and assigned a score. Your constituents could be assessed by their potential capacity – in the form of dollars. And everybody loves money. Have gift capacity ratings lived up to the hype? Yes!

Gift capacity ratings were a marketing moment for wealth screening companies. Suddenly thousands of records could be matched individually to wealth records and assigned a score. Your constituents could be assessed by their potential capacity – in the form of dollars. And everybody loves money. Have gift capacity ratings lived up to the hype? Yes!

Ryan Woroniecki is the Vice President of Strategic Partnerships at

Ryan Woroniecki is the Vice President of Strategic Partnerships at

Women may be just under half of the world’s population, but they represent 11% of the 2015

Women may be just under half of the world’s population, but they represent 11% of the 2015  The future has a way of entering slowly, day-by-day. But sometimes the writing is on the wall. The words I see on the fundraising wall are Data Analytics. Sure, you say, we all know that. But what does it mean to your organization? To you? Answer: Innovate or die.

The future has a way of entering slowly, day-by-day. But sometimes the writing is on the wall. The words I see on the fundraising wall are Data Analytics. Sure, you say, we all know that. But what does it mean to your organization? To you? Answer: Innovate or die.