Whether you are trying to improve your profiling skills on public company insiders or whether you need to upskill your research team, when it comes to insiders, it pays to keep it simple! Because once you master the core skills, it is much easier to tackle more difficult financial concepts. Following are 3 tips to keeping it simple.

1. Get really good at the two key wealth indicators first, and then keep adding to your expertise.

When it comes to public company insiders, whether they are top executives or directors, there are essentially two types of wealth information to find first: (a) annual cash (non-equity) compensation, and (b) stock (equity) holdings. Yes, there are all kinds of other equity compensation, such as stock options, performance stock units (PSUs), and more, but mastering cash compensation and stock owned right now is a big step. If you don’t have a subscription tool like KALEIDOSCOPE Insider Focus to make it easy, you can always find the Proxy Statement (Form DEF14A) by searching the Securities and Exchange Commission (SEC) database named EDGAR at www.sec.gov From the Proxy Statement you want to master two tables: (a) Executive (or Director) Summary Compensation Table, and (b) Beneficial Ownership Table. Following are some tips for you:

- On any table in the Proxy Statement, be aware of whether the number is a count (#) or a dollar amount ($).

- Read all the footnotes! Especially on the Beneficial Ownership Table, this is where you often discover how much of the count of are actually shares of stock and how much of the count is potential stock, such as options or units.

- If you don’t understand the word, look it up or let it go, but don’t add something to the profile that you don’t understand. Because of course that will be the one thing the development officer asks you about!

2. Drop the jargon for your end-user.

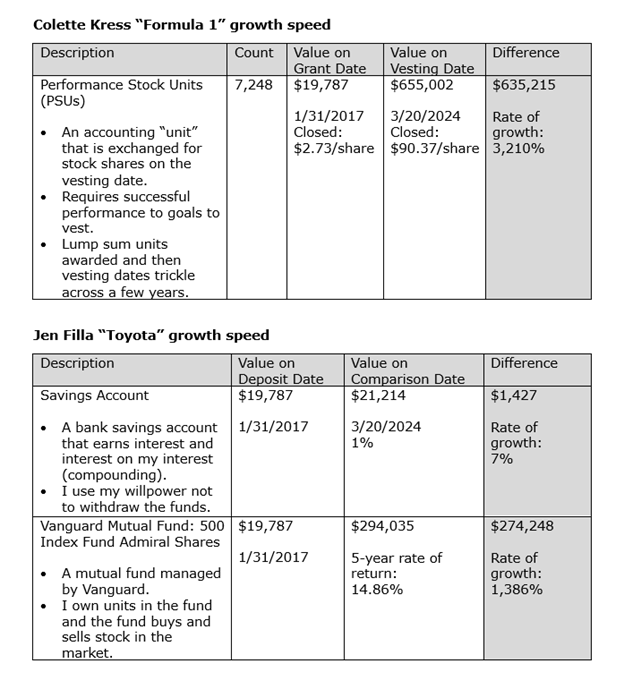

As I type this up it makes me cringe to realize how much jargon we still use at Aspire when we present insiders in our profile! It sounds easy, but it is a challenge for researchers who want to be accurate and correct to drop jargon. Of course we need to be accurate and correct, but how we present our accurate and correct information can be in plain language. Consider the difference between the two compensation tables below. Complex Non-Equity Compensation

| Salary | Bonus | Non-equity Incentive | Change in Pension Value | Other Comp | Total | |

| Year1 | $852,000 | $0 | $4,000,000 | $450,000 | $760,000 | $6,062,000 |

| Year2 | $845,000 | $1,250,000 | $3,500,000 | $125,000 | $725,000 | $6,445,000 |

This table includes all compensation that is non-equity (no stock). I have been very guilty of this for decades! (Thank you to Elise Lynch at Kaleidoscope Insider Focus who asked me why I was reporting on compensation that is not cash.) Does your development officer really need to know the change in pension value that was realized during the company’s fiscal year? Of what value is it to the development officer to know the type of other compensation, such as use of the company jet? If you are wondering whether to include information, ask yourself if it has any relevance or meaning for fundraising. If it doesn’t, drop it. Keeping It Simple Cash-Only Compensation

| Salary | Bonus | Total | |

| Year1 | $852,000 | $4,000,000 | $4,852,000 |

| Year2 | $845,000 | $4,750,000 | $5,595,000 |

This table only includes the compensation that puts cash into the insider prospect’s pocket. Even better, the table consolidates the bonus and non-equity incentive compensation. Why? Because for the everyday person, they are the same thing. Bonuses got a bad reputation during the Great Recession when insiders were paid their performance bonuses even as companies went bankrupt. If the insider met their performance obligation, then they were entitled to their bonus. To counter this negative publicity, creative professionals created a new category of “non-equity incentive” that is simply a performance bonus by another, more obscure name that the general public is less likely to understand.

3. Emphasize the context.

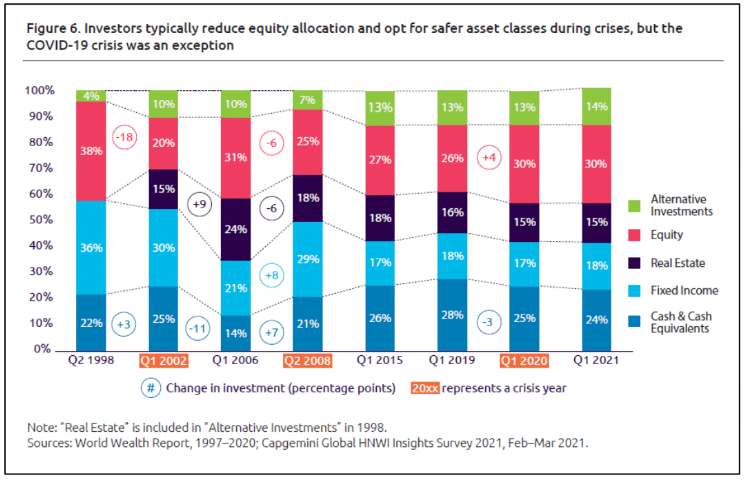

If you want to be a truly valuable intelligence asset to your major gift team, you need to do more than find, understand, and present the numbers. Even if you are an insider novice and just beginning to master cash compensation and stockholdings, you can provide key insights that could make all the difference for your development officer. Following are three simple things you can assess – especially in times of volatility or uncertainty like recession, pandemic, or political chaos – to give your development officer context for the compensation and stock values you provide in the profile.

- Stock price trends: Check the price of the stock over at least 5 years as well as the past 30 days. The stock price may have climbed quickly over 5 years and your prospect is now sitting on significant stock value. This is great! But if it just had a drop in the past 30 days – even though it doesn’t greatly affect the prospect’s wealth – it could certainly affect the prospect’s outlook on giving! When there is price volatility, including a picture or graph speaks volumes.

- How many years in public companies: If your insider prospect is sitting on his first ever public company board and has no other public company history, their wealth picture is likely to look wildly different from someone else’s 30-year public company career collecting stock the entire journey.

- Industry outlook: If you follow the business news, you will probably know when big things are happening, but regardless, it never hurts to look at recent news coverage of the company on a site like marketwatch.com You don’t want your development officer to be caught by surprise in a meeting.

Get out of your own way and get started!

If you are intimidated by SEC financial filings, you are not alone. But if you keep it simple and master the basics first, you will find it is not nearly as difficult as you thought it was. And you will be providing your development officers with fundraising intelligence they can quickly understand and act on. Hungry for more training on public company insiders? If you are looking for training on how to assess public company insider wealth from Securities and Exchange Commission (SEC) filings, check out the training offered at the Prospect Research Institute!

Additional Resources

- Insiders and the Paycheck that Keeps Paying | Jen Filla | 2025

- Public Company Insider. So What? | Jen Filla | 2025

- Common Misconceptions about Company Insiders | Elisa Shoenberger | 2025

- Behind the Headlines: Did Tim Cook really make $74.6M in 2024? | Elisa Shoenberger | 2025

- Why Insiders? | Elisa Shoenberger | Aspire | 2025