So much of what we do in prospect research revolves around finding wealth. Sometimes it sounds like the only thing we talk about is money! As I finish facilitating another Capacity Ratings Workshop at the Prospect Research Institute I am heartened to reflect that in every discussion we had about the money, we were irresistibly drawn to another rating – affinity or engagement.

I’m not trying to suggest that we don’t need to be really good at spotting high net worth individuals (HNWIs) in our database. We do! When we segment our database by wealth we are better able to focus on finding what really qualifies someone as a major gift prospect – how engaged or aligned they are with our organization.

Following are some tips for finding HNWIs who also demonstrate affinity for your organization:

- Go Beyond the Screening: Yes, verify the information in your top-rated segment, but don’t assume no-one else in your file has wealth. Professional researchers know how to identify the hidden HNW gems such as private company owners, women volunteers, and wealthy families.

- Prioritize Giving: Don’t get blinded by bling! High lifetime giving and monthly giving are great indicators for planned gifts. The savvy researcher might look for things like long-term home-ownership, too. It’s all about knowing your unique constituency.

- Leverage All of Your Data: When the gift officer and researcher work as a team, you can test out what pieces of information best prioritize your top prospects. Is it attendance at multiple events? Donors who have multiple points of communication or participation? Donors invited by other top donors to participate and give? Create a feedback loop!

- Research Wisely: Profile research isn’t about completing a form anymore. The software tools do most of that groundwork for you. When you know what wealth looks like and you know what a top donor to your organization looks like, you can research wisely. Spend more time on the most relevant information – connections to and interests in your organization.

- Prospect Smartly: Truth is that even if you are at a college or university, at some point most organizations will need to reach out to people who are not part of our existing constituency. Getting good at finding connections and having a researcher-gift officer team to better clarify what a top donor looks like to your organization (wealth + affinity) will position your organization to seize external opportunities for major gifts.

Knowing what a HNWI looks like takes practice. Read the wealth and philanthropy reports published by places such as Indiana University and Capgemini. Once you learn to distinguish between someone living comfortably and someone who has significant wealth, the next step is to understand how HNW donors give differently from others. Cultivation and messaging for this group is distinct.

And the next time you are talking about wealth or estimated net worth and someone asks, “Isn’t it more important to know if they are philanthropic?” – you now know the answer! There has to be both wealth and philanthropy to raise major gifts.

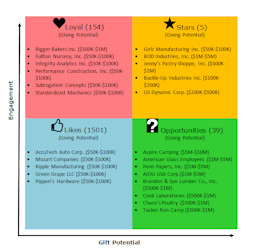

Imagine you emerge from a strategic planning session and your task is to raise more money from corporations. Your organization wants to expand its reach and you need to take the thousands of corporate donors in the database and transform them into a fundraising program. Why? Because everyone “feels” like there is a lot of opportunity there. Where do you start?

Imagine you emerge from a strategic planning session and your task is to raise more money from corporations. Your organization wants to expand its reach and you need to take the thousands of corporate donors in the database and transform them into a fundraising program. Why? Because everyone “feels” like there is a lot of opportunity there. Where do you start? “I need a profile on this person today…can’t you just Google it?” It’s the kind of question that makes prospect research professionals cringe. But why shouldn’t a development officer want it faster, better, and cheaper? Why is your organization paying thousands of dollars a year for research tools if it still takes forever to get the information needed?

“I need a profile on this person today…can’t you just Google it?” It’s the kind of question that makes prospect research professionals cringe. But why shouldn’t a development officer want it faster, better, and cheaper? Why is your organization paying thousands of dollars a year for research tools if it still takes forever to get the information needed? In this wonderful era of exciting, off-the-shelf prospect research tools and one-click-away data analysis, how is it that we still struggle to prioritize our donors and prospects? But we do. The results come in, the scores are assigned and yet there are still way more highly-rated prospects than our staff could possibly contact. Which names do we call on first?

In this wonderful era of exciting, off-the-shelf prospect research tools and one-click-away data analysis, how is it that we still struggle to prioritize our donors and prospects? But we do. The results come in, the scores are assigned and yet there are still way more highly-rated prospects than our staff could possibly contact. Which names do we call on first?

Have you ever been in a conversation with someone that felt like an argument or debate, but it turned out you were both saying the same thing, just differently? I had one supervisor where this happened quite a bit before we realized what was happening. Many times the very skills that make great frontline fundraisers and great fundraising researchers translate into two very different languages!

Have you ever been in a conversation with someone that felt like an argument or debate, but it turned out you were both saying the same thing, just differently? I had one supervisor where this happened quite a bit before we realized what was happening. Many times the very skills that make great frontline fundraisers and great fundraising researchers translate into two very different languages!

March is always an interesting month – International Women’s Day and now

March is always an interesting month – International Women’s Day and now  Do you dream of creating the perfect prospecting system? A system so flawless that the ratio of prospects to donors drops to 2:1 or even (gasp) 1:1? I do! And yet, barring advances in ESP, a 1:1 ratio feels quite out of reach. We simply don’t have access to people’s complex, internal motivations for giving until they get visited and share. Even so, we still have plenty of room to achieve better prospect-to-donor ratios.

Do you dream of creating the perfect prospecting system? A system so flawless that the ratio of prospects to donors drops to 2:1 or even (gasp) 1:1? I do! And yet, barring advances in ESP, a 1:1 ratio feels quite out of reach. We simply don’t have access to people’s complex, internal motivations for giving until they get visited and share. Even so, we still have plenty of room to achieve better prospect-to-donor ratios. Partner with a prospect research professional! As a fundraiser, why should you partner with a prospect research professional to find new prospects? Couldn’t you use a research software product or buy a prospect list?

Partner with a prospect research professional! As a fundraiser, why should you partner with a prospect research professional to find new prospects? Couldn’t you use a research software product or buy a prospect list?